Sefa presents to states and municipalities the impacts of the tax reform

Secretary René Sousa Júnior showed how the transition to the Goods and Services Tax will be, and the challenges of institutional adaptation

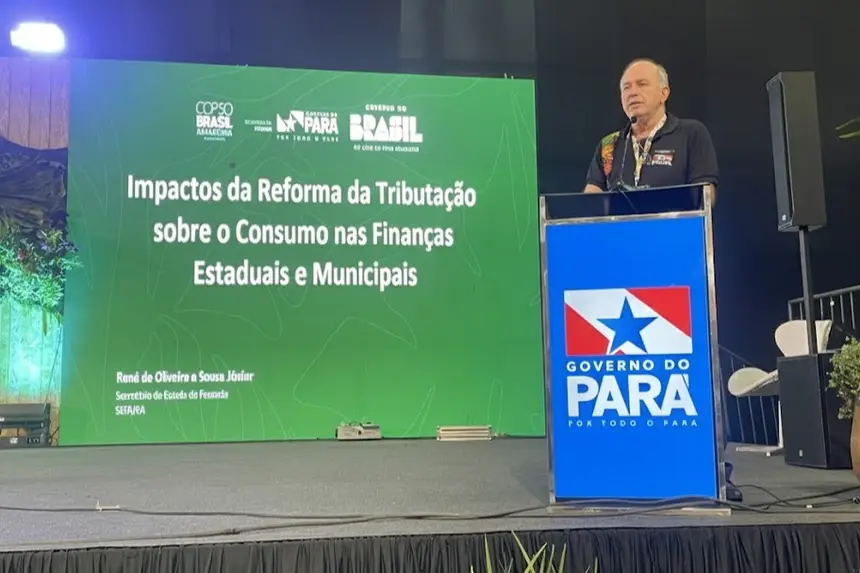

In the programming of the Pará-Municipal Pavilion, within the scope of COP30, the State Department of Finance (Sefa) presented, this Tuesday (18), the theme "Impacts of the Tax Reform on States and Municipalities", aimed at municipal public managers, technicians from the areas of finance, planning, and collection.

The Secretary of State for Finance, René Sousa Júnior, addressed the impacts of Constitutional Amendment No. 132/2023 and Complementary Law No. 214/2025 on the Federative Pact, and showed how the transition to the new taxation model with the IBS (Goods and Services Tax) will be, the challenges of institutional and technological adaptation, and the role of municipalities in shared governance.

Share of the quota - According to the legislation, 25% of the ICMS and 50% of the IPVA amounts belong to the municipalities. The ICMS amounts are distributed among the 144 Pará municipalities according to the following criteria: 65%, in proportion to the added value, and 35%, according to what the state law provides.

The 35% are distributed according to the following criteria: 10% Educational Index; 10% in proportion to the population; 8% by Ecological Indices; 4% in equal parts and 3% in proportion to the territorial surface.

From 2033, the criteria will be those provided for in Article 158 of Constitutional Amendment 132/2023: 80% in proportion to the population; 10% based on indicators of improvement in learning outcomes and increased equity; 5% based on environmental preservation indicators, and 5% in equal amounts for all municipalities in the State.

Changes – René Sousa Júnior stated that "many changes will come with the creation of the Goods and Services Tax. One of them will be the shared competence between states, municipalities, and the Federal District. The administration of the tax will also be joint with the Union, through integration with the Federal Revenue."

Municipalities will have to restructure tax administration, plan the fiscal transition, monitor the actions of the IBS Management Committee, and seek greater integration with the local economy to ensure stability in revenues.

The state and municipal treasuries will be impacted with greater integration and administrative uniformity, which can reduce litigation and improve efficiency. But there will be significant challenges, such as adapting to a new system of shared governance, with a loss of autonomy over the ICMS and ISS. The transition will last until 2033, when the new tax will come fully into effect.

Reflections and equity - Next Thursday (20), at 4 PM, the theme "Impacts of the Consumption Tax Reform on State and Municipal Finances" will be presented, also in the Municipal Pavilion, analyzing the effects of replacing the ICMS and ISS with the Goods and Services Tax, and the reflections on the financial autonomy of municipalities.

The coordinator of the Tax School, Cristina Viana, and Paulo Victor Squires, consultant of the IDB (Inter-American Development Bank), will address, on the 20th, at 4 PM, at the booth of the System of Courts of Accounts at COP30, in the Green Zone, the actions that Sefa carries out within the scope of the Pro-Equity Racial Pact, promoted by the State Court of Accounts (TCE), especially regarding the ethnic-racial survey of the Secretariat's servers.