Sefa highlights eco taxation and strengthening sustainable development in the Green Zone of COP30

Secretary René Sousa Júnior presented the criteria of the Green ICMS and emphasized the challenges and advances of Pará in environmental fiscal policy during a lecture at the Court of Accounts' booth.

The State Department of Finance (Sefa) reinforced, this Saturday (16), in the Green Zone of the 30th United Nations Conference on Climate Change (COP30), in Belém, the strategic role of eco taxation to promote sustainable development in Pará. The presentation was conducted by the Secretary of Finance, René Sousa Júnior, at the invitation of the State Court of Accounts (TCE), at the booth of the Court of Accounts system.

The president of the TCE, counselor Fernando Ribeiro, highlighted the relevance of Sefa's actions in balancing public accounts. According to him, "the good performance of fiscal management allowed the state government to increase investments, one of the factors that enabled Belém to host COP30, along with resources from the federal government."

Eco taxation as a preservation tool

During the presentation, the secretary explained that eco taxation is a fiscal strategy that uses tax mechanisms to encourage sustainable practices and discourage polluting activities. "One of these strategies is the Green ICMS, aimed at rewarding and compensating municipalities that have large areas of environmental preservation. The idea is to preserve the environment without municipalities suffering losses in tax revenues, promoting sustainable development and improving the quality of life for the population," said René Sousa Júnior.

The manager emphasized that Pará uses ecological criteria in the distribution of the municipal share of the ICMS. In the state, the Ecological ICMS serves as a tool for articulating socioeconomic development and environmental protection, promoting the appreciation of responsible practices and the planned use of territory.

Current criteria and municipal performance

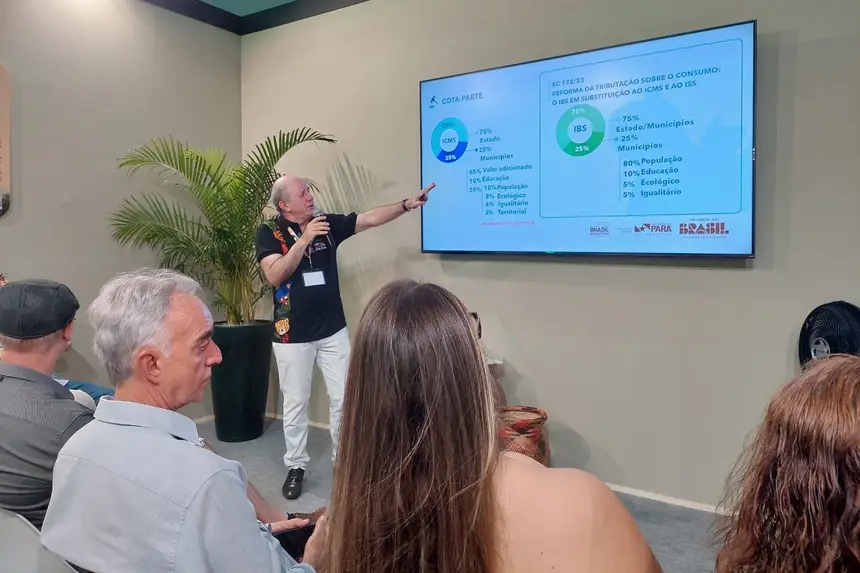

René Sousa Júnior detailed the legislation that guides the distribution of the ICMS. According to the Federal Constitution, 25% of the tax revenue goes to municipalities. In Pará, State Law No. 5.645/1991 establishes that 35% of this amount is distributed according to educational, population, ecological, territorial, and egalitarian criteria.

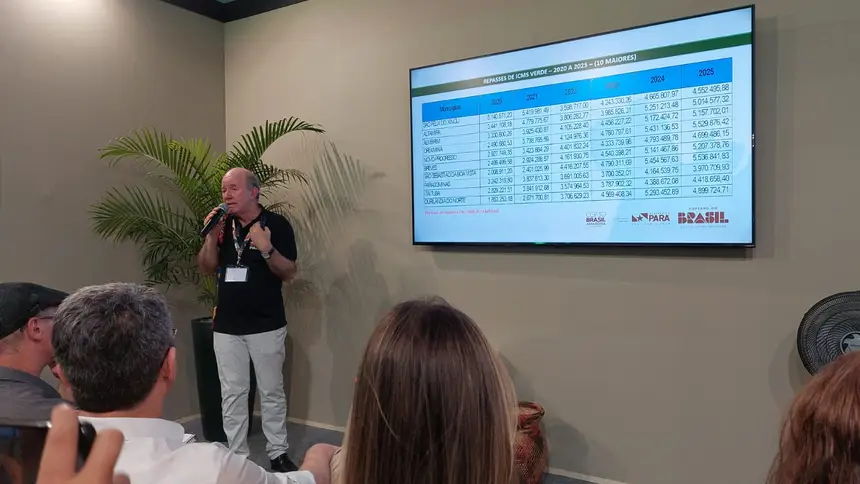

According to the secretary, the municipalities with the highest share values are those with large territorial extensions, conservation units, traditional communities, and indigenous lands, mainly in Marajó, Xingu, and Western Pará. Among them are Altamira, Novo Progresso, Oriximiná, São Sebastião da Boa Vista, and Afuá.

On the other hand, municipalities with lower indicators show low environmental contribution, urbanized or agriculture-intensive areas, and little environmental management structure, especially in northeastern Pará. Between 2020 and 2025, the best ecological indices were recorded by São Félix do Xingu, Altamira, Almeirim, Oriximiná, and Novo Progresso.

Tax reform and implementation challenges

The secretary also explained that the tax reform on consumption, provided for in Constitutional Amendment 132/2023, will change the criteria for the distribution of the ICMS starting in 2033. The new model will prioritize population, educational, and environmental indicators, as well as equal distribution among municipalities.

One of the main challenges pointed out by the head of Sefa is the municipal regulation of the Green ICMS. Law No. 7.638/2012 determines that each municipality organizes its own municipal environmental system, and Decree No. 1.064/2020 assigns municipalities the definition of the allocation of resources. However, many Amazonian municipalities, such as Altamira and São Félix do Xingu, concentrate areas of preservation under federal or state management, which limits local capacity to implement environmental policies.

In closing the lecture, René Sousa Júnior reinforced that tax administration plays a central role in encouraging environmental preservation. According to him, instruments such as tax incentives and differentiated taxes can be applied to discourage activities associated with deforestation.