Incentives Policy Commission approves targets for beneficiary companies in Pará

With the granting of tax treatment, the incentivized projects are now monitored by the Commission, which evaluates compliance with the established conditions.

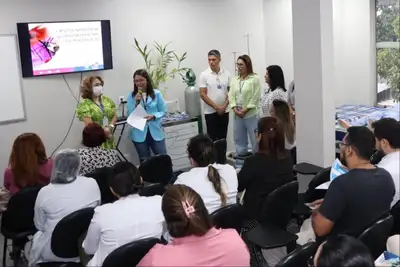

The fourth meeting of the State's Socioeconomic Development Incentives Policy Commission was held on Wednesday (5), with the approval of 15 monitoring reports on targets and compliance regarding the activities of companies benefiting from the Government of Pará's incentives. Two other projects were also approved: one for renewal incentives and another for revision, in addition to monitoring and evaluating other relevant topics for the Commission's activities.

With the granting of tax treatment, the incentivized projects are now monitored by the Commission, which evaluates compliance with the conditions established in the respective projects.

The Monitoring Group for Incentivized Projects (Gapi) is responsible for preparing reports that are sent to the Technical Chamber, which analyzes the data and forwards it to the Commission for final deliberation.

Among the companies that had their reports approved are: Bertuol Fertilizer Industry; MGPEL Cardboard Industry Ltda., located in Santa Izabel do Pará, in the Metropolitan Region of Belém; Tramontina S/A, with operations in the Icoaraci Industrial District (a district of the capital); Ocra Cacau da Amazônia Ltda., specialized in processing cocoa derivatives, located on the Tapanã road in Belém.

Other companies that received approval include: Nobre Industry and Commerce, producer of canned hearts of palm, headquartered in Breves, in the Marajó Archipelago; Quality Temper Glass, in the tempered glass segment, in Ananindeua (Metropolitan Region); Riopel Industry and Commerce of Paper Scraps Ltda., producing cardboard packaging in Ananindeua, and Granfruto, an industry of açaí pulp and sorbet, with a unit in Castanhal (Metropolitan Region).

Also on the list are: Vieira e Santos Food Commerce, engaged in the production of fruit preserves, in Abaetetuba (in the northeast of the State); Premazon precast concrete and fiber, with an industrial plant on PA-483, Alça Viária; 2 ML Mortar Industry Ltda., manufacturer of mortars, paints, additives, and waterproofing products, in Marabá (in the southeast); Natura BR Cosmetics Industry and Commerce, with an industrial park in Benevides (Metropolitan Region); Fertitex, producer of fertilizers and agricultural inputs, in Santarém (in the west), and Gazin Mattress Industry.

Impacts - The Deputy Secretary of Sedeme, Carlos Ledo, led the meeting and emphasized the importance of monitoring incentivized projects, aiming to verify the impacts on economic development, the estimated job creation, and, mainly, the fulfillment of the targets agreed upon with the state government.

Luiz Ribeiro, Operational Secretary of Secop (Operational Secretariat of the Incentives Policy Commission), highlighted in the meeting the relevance of the joint work between the Technical Chamber and Gapi. According to him, the fundamental role of Secop in promoting public transparency of companies benefiting from incentives, through the dissemination of information on the Sedeme website, in accordance with public transparency guidelines.

Support - Secop is the auxiliary body for logistical and administrative support of the Incentives Policy Commission, and its competencies are regulated by Art. 11 of Decree No. 5,743, of December 20, 2002. The management of the Incentives Policy is conducted by a mixed commission, composed of representatives from state agencies and secretariats, under the presidency of Sedeme, represented by the head of the Secretariat, Paulo Bengtson.

The secretary reaffirmed the commitment of the Government of Pará to promote and support the establishment of new enterprises in the State, based on technical and economic criteria that promote productivity, competitiveness, and strengthening of the Pará industry.

Tax incentives - Companies that join the Program receive a tax incentive of 50% to 90%, which can reach 95%, depending on the strategic activity. The enjoyment period is at least seven years and a maximum of 15 years, which can be extended up to an additional 15 years, totaling 30 years.

Incentives can be granted in cases of establishing new enterprises, expansion, diversification, and acquisition of machinery and equipment for the industrial process.