Tax reform discussed at the Tax Education event in Santarém

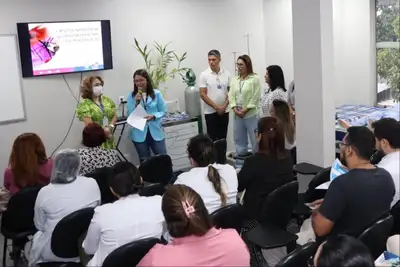

The aim of the meeting was to promote the best practices of Tax Education projects. The event brought together public servants and taxpayers.

The municipality of Santarém held, this Thursday (25) and Friday (26), the Tax Education Week, organized by the Municipal Tax Education Group, to promote the best practices of Tax Education projects. The event brought together public servants and taxpayers.

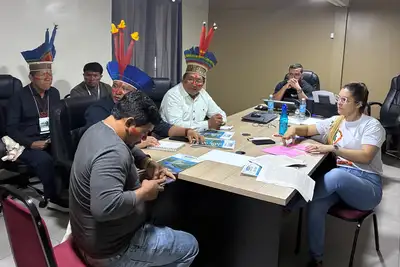

The Undersecretary of Tax Administration of the State Department of Finance (Sefa), Eli Sòsinho, participated in the program on Thursday, speaking about "The impacts of implementing tax reform for municipalities."

Complementary Law No. 214/2025 regulated the Tax Reform provided for in the Complementary Amendment (EC) 132/2023. The measure will profoundly impact state finances, which will have shared management of the Goods and Services Tax (IBS), which will be managed by the Management Committee. For this, there will be a transition process from the current model to the new tax system.

The ICMS (Tax on Circulation of Goods and Services), which was the responsibility of the States, will be abolished, as will the Tax on Services (ISS), which is a municipal responsibility. "The IBS will be a tax of shared competence between States, municipalities, and the Federal District, and its administration will also be joint with the Union, through integration with the Federal Revenue," clarified the Sefa undersecretary.

During the transition period, which will be between 2026 and 2032, States will have to coexist with both the ICMS and the IBS, requiring parallel systems for inspection and collection. It will be necessary to make adjustments to taxpayer registrations, tax meshes, electronic invoices, and other systems; training of servers and investments in Information Technology (IT) for integration with the national IBS platform. The law provides guidelines for cooperation between federative entities.

These adjustments will also be necessary for municipalities, informed the state revenue tax auditor, highlighting the importance of municipalities preparing for the changes that will occur in the coming years.

"State finances must act in synergy with municipalities and the Union, especially through the Management Committee. The reform on consumption may alter the way resources are distributed among federative entities (Union, States, and municipalities), impacting their revenues and, consequently, their public accounts. On the other hand, the simplification of the tax system may reduce administrative and inspection costs, generating savings for the government," warned Sòsinho.